Sell to Art Gallery Vs Sell to Collector Sim 4

Abstruse

The evolution of the art ecosystem is driven by largely invisible networks, defined by undocumented interactions between artists, institutions, collectors and curators. The emergence of cryptoart, and the NFT-based digital marketplace around it, offers unprecedented opportunities to examine the mechanisms that shape the evolution of networks that define creative exercise. Here we mapped the Foundation platform, identifying over 48,000 artworks through the associated NFTs listed by over 15,000 artists, allowing united states of america to characterize the patterns that govern the networks that shape artistic success. We find that NFT adoption past both artists and collectors has undergone major changes, starting with a rapid growth that peaked in March 2021 and the emergence of a new equilibrium in June. Despite significant changes in action, the average price of the sold art remained largely unchanged, with the price of an artist'southward work fluctuating in a range that determines his or her reputation. The artist invitation network offers testify of rich and poor artist clusters, driven by homophily, indicating that the newly invited artists develop like date and sales patterns equally the artist who invited them. We find that successful artists receive disproportional, repeated investment from a small-scale grouping of collectors, underscoring the importance of creative person–collector ties in the digital market. These reproducible patterns permit us to characterize the features, mechanisms, and the networks enabling the success of private artists, a quantification necessary to ameliorate understand the emerging NFT ecosystem.

Introduction

Despite the of import social, cultural, and historical role art plays in the order1,ii,three, the evolution of the art ecosystem lacks transparency, being driven by largely invisible interactions between artists, institutions (galleries, museums), collectors and curators. In other words, creative success is controlled by gate-keepers and breezy networksfour,v, that rely on information that is available only to those with privileged admissionhalf-dozen. In dissimilarity with science, whose main output, the research papers, are publicly bachelor and catalogued in databases, we lack systematic data on the list of works (products) and the transactions that shape the development of the fine art ecosystem. Consequently, while a new subject area called the scientific discipline of scienceseven,8 has emerged to explore the quantitative patterns characterizing science, creative careers have largely resisted quantification9. This has changed recently with the emergence of crypoart, and the cryptocurrency-based digital marketplace built-in around it, in which all transactions are open and visible. The resulting transparent art ecosystem is accessible to all participants without formal gatekeepers and barriers10, offering unprecedented opportunities to quantify and empathise the forces, mechanisms, and hidden networks that shape its evolution.

A Not-Fungible Token (NFT) is a permanent and certifiable online tape that connects a digital artwork, frequently called cryptoart, to its owner. Virtually NFTs are listed on an Ethereum monitored decentralized cryptocurrency platform that utilizes blockchain technology, normally used to power millions of transactions across the earth for multiple applicationsxi. Each transaction pertaining to an NFT and the associated artwork is stored in a ledger via a Proof-of-Work (Prisoner of war) mechanism, enabling easy and fail-proof transfer of digital assets, and verifiable ownership of art12,13. Hence, NFTs14 offer a mechanism for artists to create digital works of art and validate their piece of work equally unique, eternal, and worth collectingxv,16, and offers collectors the ability to showcase their collections on digital platforms. Driven by this technological innovation, digital art experienced $2.5 Billion in sales just within the first two quarters of 202117.

The trading of cryptoart is mediated by trading platforms like OpenSea, NiftyGate, SuperRare, Foundation, and others. Previous research on cryptoart has focused on 1 of the primeval platforms, SuperRare, which is a curated, invitation based cryptoart gallery, exploring the evolution of the marketplaceeighteen, co-ownership patterns19, evaluation by expert art curatorstwenty, and re-sale dynamics21. Here we focus on Foundation (https://foundation.app), launched in February 2021, a apace growing artist-driven platform, focused on highlighting the art of recognized artists. In contrast with platforms similar SuperRare and NiftyGate, where new artists are accustomed slowly through an application process, Foundation is an open platform, meaning that whatsoever agile artist or collector can invite new artists. This decentralized access has turned Foundation into an organically and apace growing market place whose evolution mirrors the demand and interest in cryptoart. Given its open architecture, through Foundation we tin can trace the dynamics of creating, behest, buying, and selling art, assuasive usa to map out the circuitous interconnected network that govern the relationships betwixt artworks, artists, and collectors. Farther, it allows united states to investigate creative careers, the emergence and influence of social networks betwixt artists9,22, their multiple stakeholders23,24, and the patterns that govern the success of private artists.

Information drove

Each artwork (NFT) minted on Foundation contains a unique contract address followed past a unique identifier for the artwork (also indexed through tokens). For example, 1 of its early adopters, NyanCat, sold a viral animation of a true cat on February 19, 2021, for 300 Ethereum (worth over a million USD today; https://foundation.app/NyanCat/nyan-cat-219). NyanCat's art tin can exist institute on the Ethereum network as contract address 0xiiiB3ee1931DcthirtyC1957379FAc9aba94D1C48a5405 and token id 219, two pieces of information that permit us to identify all of the artwork minted on Foundation. We used the public open-source Graph API (https://thegraph.com/) to extract the metadata almost the artworks, identifying the creator of the artwork, minting and listing time, all the bids (monetary offers to purchase it), allowing usa to reconstruct the selling (primary market) and re-selling (secondary market) history of each artwork. This data extraction mapped 50,723 minted artworks, of which 48,059 (94.seven%) are listed for auction, and 15,279 (31.vii%) have been sold. The listed artworks have collectively received 37,013 bids from 7787 bidders. We notice that 1928 (12.61% of all sold) artworks have been re-listed for sale on the platform, and 138 (seven.15%) have re-sold. This indicates that Foundation is predominantly used for primary sales, compared to SuperRare, which has a more than robust secondary marketxix,21. Equally a event, we focus only on the master marketplace, i.e. the list of the artwork by the artist and its first buy by a collector.

The artists and collectors on the platform accept a unique etherscan wallet id that they utilize to listing and bid for art. Nosotros used this id to extract the contour metadata of each user, together with the listing of followers (i.eastward. other users that follow that artist on the Foundation platform), links to social media sites like Twitter and Instagram. Nosotros extracted metadata data about 15,366 artists and 5534 collectors on the platform and the twitter metadata for 13,487 (87.7%) artists, including contour address, the number of followers and following. To control for the changing monetary value of Ethereum tokens, nosotros map the ETH bidding corporeality to its USD price at the solar day of auction (https://etherscan.io/chart/etherprice). The dataset, extracted on June 18, 2021, is available on a Github repository at https://github.com/Barabasi-Lab/crypto-art, along with the lawmaking used to crawl the data.

Results

The ascent and the autumn of the NFTs

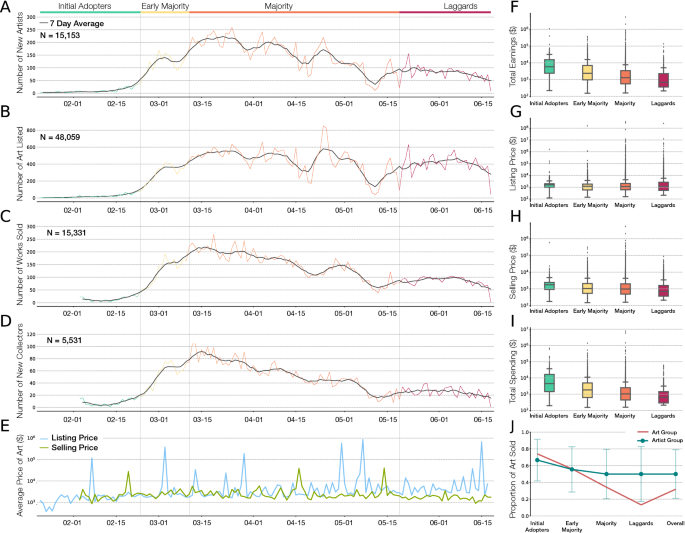

To understand the temporal and historical dynamics of cryptoart, we begin by investigating the patterns of activity of the Foundation platform, focusing on new artists (Fig. 1A), art listed (Fig. 1B) and sold (Fig. 1C), and the arrival of new collectors (Fig. 1D). The data indicates that the adoption of digital fine art exploded in belatedly Feb 2021, peaked during March, and institute a new steady state around May 2021. This pattern is particularly obvious if nosotros inspect the arrival of new artists, indicating that the platform attracted an exceptional number of new artists in mid March and April, following Christie's attention-grabbing sale of Beeple'southward art for $69,346,25025. However, early on May the number of new artists briefly dropped dorsum to its early on-March level (Fig. 1A), raising again to reach a new steady state. This ascension and autumn is as well well documented by the number of art sold and number of first-time collectors on the platform (Fig. 1C, D), curves whose temporal trends strongly correlate with the number of new artists.

The timeline of NFT adoption on foundation. (A) Number of new artists listing fine art, indicating that many artists joined the platform in March and that adoption reached a new equilibrium post-obit a turn down in May. (B) Number of new art listed on the platform. (C) Number of artworks sold on the platform. (D) Number of new collectors purchasing art. (E) The daily list and selling price of art, indicating that despite the changes in NFT adoption rate, the economic value of art has remained unchanged. (F) The earnings of innovators, early bulk, majority, and laggards, showing that early artists have enjoyed higher earning than belatedly joiners. (G) The list price of art in the 4 artist groups. (H) The selling price of art grouped past selling date. (I) The spending of collectors inside each grouping, indicating that early collectors have been college spenders than the tardily comers. (J) The selling rate of art within each artist and art group, showing that artworks listed in early on groups have sold at a higher rate than in the belatedly stages. Error confined show the standard deviation.

This adoption timeline allows united states to investigate the patterns of success within each group, defined by the time when each artist/collector listed/bought art on the Foundation platform. While new artists and collectors continue to join the platform, they do and then in smaller numbers, and the desire to purchase large number of artworks within curt periods of time has faded, allowing the system to reach a new steady state activity level. Note, however that the decline in the adoption of new artists and new collectors in May does not imply a return to the pre-March attending to NFT's as in that location are 13 times more artists and 12 times more collectors on the platform on June 1 than there were on March i. Rather, the saturation of the adoption procedure suggests that most artists and collectors that intended to adopt in the starting time wave of the NFT art movement have already joined the platform.

Commencement movers' advantage in sales and valuation

Innovation enquiry classifies the adoption of new technologies into five temporal stages26,27: (1) Adoption by innovators (or initial adopters), which in our example corresponds to the beginning two.5% artists/collectors who joined the platform (from 21 Jan, 2021 to 22 February, 2021); (2) Arrival of early adopters (or early bulk), representing the next 13.5% (from 23 Feb to 10 March); (3) Emergence of bulk (34%) and late majority (34%) between xi March to 18 May (4) Adoption by laggards, representing the final 16% (19 May to eighteen June). The earnings of artists and the selling price of fine art in the different adoption stages helps the states understand the advantage of the early on adopters. Indeed, we find a monotonic decrease in total earnings with adoption time, indicating that artists who joined the platform subsequently have earned considerably less than the artists that entered early (Fig. 1F).

Similarly, collectors who joined the platform later take spent less than the early on adopters (Fig. 1I). These trends, however, may only represent a cumulative effect: those who arrived at an before fourth dimension had more opportunities to sell or purchase art. Yet, if we normalize past time on platform, the first movers' reward persists: initial adopters have earned more than the early majority, which in plow earned more than than the laggards, a pattern characterising collector spending besides (SI Fig. S2B, F). Early artists have likewise sold more fine art for a higher average toll than the late comers' (SI Fig. S2A, C, Normalized: D), and early collectors accept invested in more art at a higher price than new collectors (SI Fig. S2E). This indicates that early adopters have established themselves as successful digital artists and collectors, benefiting from a first-mover advantage28,29.

Interestingly, the rise and the decline of interest in NFTs (Fig. 1A–D) has not afflicted the average listing or selling cost of the artworks: the daily listing and selling cost has stayed remarkably stable over the explored five month catamenia (Fig. 1E; for grouped counts see Fig. 1G, H). In other words, the value of the art has remained largely unaffected past the major influx of artists and collectors in the NFT space, and the complex temporal dynamics of the platform. Furthermore, the time it takes to sell an artwork as well remained unchanged in this menstruum (SI Fig. S4). What has changed is the likelihood that a listed artwork does sell, measured as the fraction of the sold inventory (Fig. 1J): 74.one% of the fine art released during the innovator flow has found a collector, but but 13.iii% of the art released during the laggard period sold.

Overall, we notice that new artists have a macerated ability to sell art due to 2 connected factors (ane) there is a considerably large inventory on the market, making it difficult for new artists to attract the attention of collectors and (ii) the urge to buy digital art has stabilized. It is rather remarkable, yet, that this complex market place dynamics has not affected the listing and the selling price of art.

In-platform followers shape valuation

On Foundation, collectors tin can keep track of their favorite artists and their new art by following them, hence the number of followers of an artist captures the collective interest in an artist's work. Most artists are besides present on Twitter, and many of them regularly tweet their new piece of work released for sale on Foundation. This raises several important questions: to what caste does visibility on social media, similar Twitter, interpret into visibility on the Foundation platform, as measured by the number of Foundation followers? Does external (Twitter followers) and internal (Foundation followers) visibility affects the value of the art and the likelihood to discover a buyer?

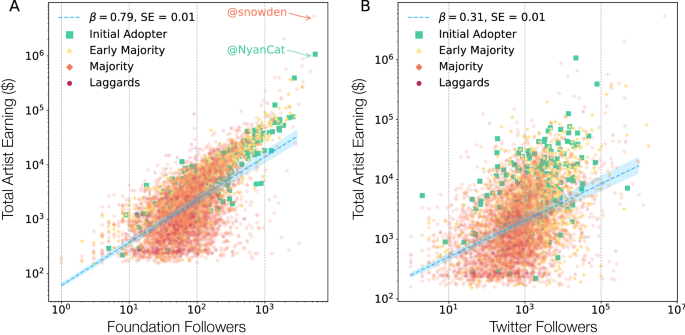

To respond these questions, we measured the number of followers an creative person has on the Foundation platform (internal) and the number of followers on Twitter (external). To test the effect of this visibility on sales, we quantified the impact of the number of followers on an artist's earnings (see SI 4). Nosotros find that the total artist earning grows as \(N_{followers}^{\beta }\) with \(\beta = 0.792\) (CI [0.768–0.816]), capturing a strong sublinear growth with the number of Foundation followers (Fig. 2A). We discover a particularly strong correlation with the maximum price an creative person receives for his or her piece of work (Foundation \(\beta = 0.935\)). For case, NyanCat with 5530 followers on Foundation has sold v artworks for a total of $1,078,247. At the same time the Twitter follower count is a weaker indicator of artist earning (\(\beta = 0.305\); CI [0.288–0.322]), indicating that visibility on Twitter doesn't translate into earnings on Foundation (Fig. 2B). In other words, prestige and the earning ability of an artist is derived primarily from his or her visibility on the Foundation platform.

The affect of follower count on artist earnings. We mensurate the number of followers on Foundation (internal) and Twitter (external) for each artist to measure the office of visibility on artist earnings. (A) The number of Foundation followers vs the total artist earning, finding a sublinear scaling with exponent \(\beta = 0.79\) (CI 0.76–0.81; \(R^2 = 0.41\)), indicating that the more foundation followers an artist has, the higher the auction price of his/her work. Unsurprisingly, the top earning artist on Foundation, NyanCat, also has the about followers on the platform. (B) The number of Twitter followers and the total creative person earning, finding that Twitter is a weaker indicator of artist earning, with a sublinear scaling of exponent \(\beta = 0.31\) (CI 0.28–0.32; \(R^ii=0.18\)). These results indicate that creative person success depends on both platform and outside visibility, but measures of external following have weaker impact compared to the internal on-platform following.

The social network of the artists

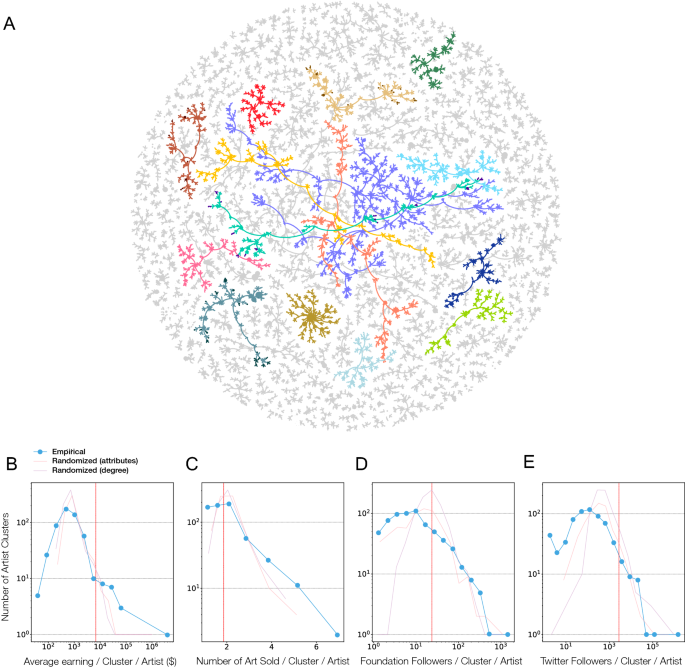

Foundation is an organically growing platform, as it allows artists who have listed art on the platform and collectors who accept purchased fine art to invite new artists. Information of who invited whom is displayed on each creative person's page, allowing usa to map out the social network that fuels the adoption of the platform by new artists. Defining a node as an creative person and a directed link marking who invited the artist to the platform, we obtain an artist network with 14,706 nodes (artists) and 14,066 links (invitations), which is fragmented into 640 isolated components (artist clusters) with an average community size of 22. Each artist cluster forms a tree, and we find that 594, or 91% of the clusters have emerged inside the first 100 days of the platform, each containing on average 16 artists (SI Fig. S6). These early on artist groups initiated the subsequent growth of the platform (SI Tab S2), inviting further artists (Fig. 3A).

The creative person social network. (A) The beginning 100 days of artist adoption through invites. Each node corresponds to an artist and a directed link connects an artist to the artist who invited him or her to the platform. We testify all clusters with more than 10 artists, resulting in a full of 13,010 nodes and 204 clusters. The peak 20 artist clusters in terms of number of artists are colored and nodes are sized based on the number of artworks sold. The largest component (regal) consists of 941 nodes. To characterise the creative person clusters, nosotros perform two types of randomization, the starting time involves shuffling the node attributes and the second involves caste preserving link randomization. (B) The distribution of average earning per art per creative person cluster, finding the emergence of poor and rich clusters, both extremes absent in the random reference data. (C) The distribution of number of art sold per artist per cluster, finding that artists in some clusters sell a lot more art than expected past chance. (D) Number of Foundation followers per artist per cluster and (E) Number of Twitter followers per artist per cluster, finding the existence of low and high popularity within communities, extremes absent-minded in the random reference fix. Red line indicates the average value of each of the empirical distributions.

For example, the largest artist cluster has 941 artists (ix.26% of all), initiated by the artist sergeposters, who listed his first artwork on February 6, 2021, and invited 10 other artists, which in turn invited 43 others, who and then invited 86 others, and and then on, resulting in a cascade of adoptions. The resulting artist cluster collectively is responsible for $1,661,173 in sales from 867 artworks, raising the question if the artists' success in selling art depends on the cluster she joined. We therefore measured the distribution of the boilerplate earning per art per creative person in each cluster, finding it to exist skewed to the right, indicating the presence of a few clusters whose earnings is much college than expected if the artist clusters formed at random (Fig. 3B). Indeed, in the empirical network, the maximum earning cluster collected $2,703,171 (with a hateful of $6766), while in the randomized reference, where nosotros shuffle the node attributes and conduct a degree preserving link randomization, the largest earning cluster has $901,796 (with a mean of $2684). Such high-earning clusters continue to persist if we disregard the highest earning artwork within each cluster (SI Fig. S8). In the opposite limit, we too find evidence of "poor clusters", i.eastward. clusters whose artists earn less than expected by chance. Taken together, we observe a segregation into both rich and poor artist communities, extremes absent in the random reference data. The differences betwixt the creative person clusters are as well captured by multiple measures, from the number of artworks sold (Fig. 3C) to the number of Foundation followers (Fig. 3D), and the number of Twitter followers (Fig. 3E).

Finally, we find that the differences betwixt artists and their invitees in terms of earnings, number of art sold, and followers to exist minimal, bear witness of a potent homophily at the private artist-invitee level (SI Fig. S7). In other words, the earnings of a new artist tend to be like to that of its invitor, offering evidence that the social network of artists is congenital through a unique combination of perceived reputation and follower base, that leads to a self-organized emergence of clusters that subsequently determine the success of private artists.

Patterns of artist success

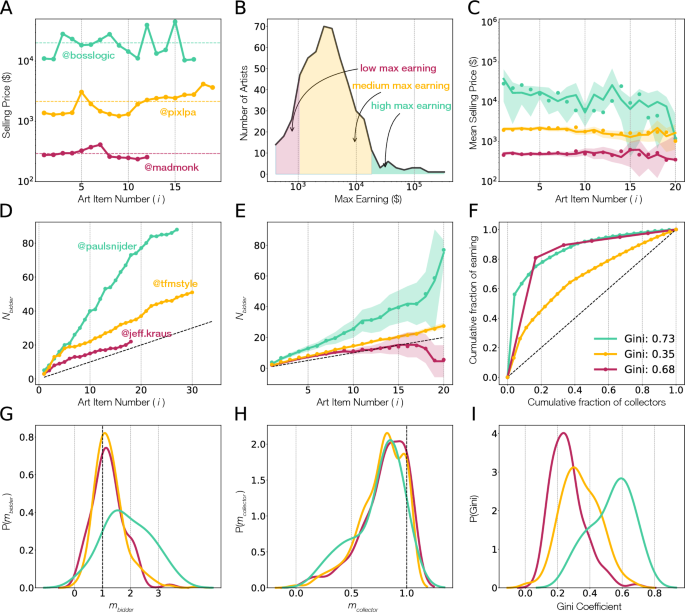

In the classical art market, the price of the artworks and the number of sold works grows with the artist'due south increasing reputation. Some of this growth is maintained past galleries, who hold the price of art fifty-fifty when demand drops. Equally the NFT space lacks galleries as gatekeepers, we were curious if reputation furnishings have naturally emerged. We ask therefore, what is the impact of the previously sold art on the future cost of the piece of work by the aforementioned artist. Interestingly, the price history of the top selling artists fails to betoken an increasing trend in the art toll (Fig. 4A). Rather, information technology is not uncommon to take significant differences betwixt subsequent sales (SI Fig. 12). For example, a high selling creative person Allo sold his/ her fifth artwork for $2028, while the subsequent works fetched only $274, $332, $647, $818 respectively, while the tenth art selling again for $2178. Similarly, bosslogic sold his/ her eighth artwork for $27,987, just the subsequent works found lower sales of $18,165, $14,443, $11,082, until the twelfth work sold at much college price bespeak of $39,708 (Fig. 4A, greenish).

The emergence of creative person reputation. (A) The toll of subsequent art sales (i) for three artists, bosslogic, pixlpa, and madmonk. The lines indicate the average sales price for each artist. (B) Nosotros grouped artists who sold more than 5 artworks based on their max selling price, allowing us to distinguish high reputation (green, elevation v%), medium reputation (yellow, middle 75%) and low reputation (cherry, bottom 20%) artists. (C) The evolution of the selling cost of an NFT as a office of the fine art item number for high, middle and low reputation artists. Symbols bespeak the true observations while the shaded area indicates the random reference, obtained by randomizing artists careers (95% confidence interval). (D) The growth in the cumulative number of collectors (\(N_{bidder}\)) bidding for the piece of work of iii artists, paulsnijder, tfmstyle, and jeff.kraus. (E) The growth in the number of bidders (\(N_{bidder}\)) for different artist groups, highlighting the differences in growth rates based on artist reputation. Symbols bespeak the true observations and the shaded regions represent the randomized careers (85% conviction interval). (F) The inequality curve (Gini coefficient) of investment by different collectors for the piece of work of the same three artists as in (D). We quantify the linear growth in the collector base by measuring the slope of the rise in cumulative number of bidders (\(m_{applicant}\)) and collectors (\(m_{collector}\)). (M) The density office of \(P(m_{bidder})\) signalling bidder growth rate. (H) The density function of \(P(m_{collector})\) showing collector growth rate. (I) The Gini coefficient distribution of artists for different artist groups. The coefficient ranges from 0 (perfect equality) to 1 (perfect inequality), demonstrating that the investment by collectors for loftier reputation artists is highly unequal.

Despite these fluctuations, we also notice a certain degree of stability, finding that for most artists the sales price fluctuate in a well-divers range. For instance, bosslogic repeatedly attracts sales in the range of $ten,000 to $30,000 (Fig. 4A, green), while pixlpa sells fine art in the range of $g–$2000 (Fig. 4A, blue). In contrast, for madmonk the sales prices are regularly much lower, in the range of $250–$350 (Fig. 4A, orange). In other words, while sales prices do show considerable variability, they fluctuate within a predictable range that defines the reputation of an artist (SI Fig. ix).

To quantify the office of reputation in the NFT space, we categorized all artists into three groups based on their highest private auction cost: the bottom twenty% (low reputation, summit sale being less than $1254), the center 75% (medium reputation, elevation sales between $1254 and $eighteen,510), and the top 5% (high reputation, highest auction above $xviii,510) (Fig. 4B). The iii artist groups are also separated based on number of followers indicating that reputation correlates with popularity (SI Fig. 10). We find that artists within each of these groups experience simply nominal changes in their sales patterns, i.e. high performing artists continue to receive higher number of bids for new art (SI Fig. 11) and repeatedly attract high prices for their new fine art, while low reputation artists have difficulty enervating higher prices (Fig. 4C). In summary, the sales price of the art by the same artist shows a degree of stability over time, indicating the emergence of reputation effect in crypto art, similar to those observed in scientific careers30.

The impact of sustained artist–collector ties

In the traditional art space, collectors discover new artists through gallery and museum exhibits. In turn, gallerists work with curators to create opportunities for emerging artists to showcase their work, both in the galleries and in museumsnine, bringing it to the attending of collectors. As the cryptoart space lacks the formal role of gallerists, curators and museums, success in this space is mediated by potential direct relationships betwixt artists and collectors. We therefore ask, what is the role of collectors in the success of private artists? We find that the continued activity of an creative person attracts collector attention: the number of bidders interested in a given artist'south work grows with the number of sales by the artist (Fig. 4D, Due east). We judge the linear growth rate of an creative person's collector base measuring the gradient of the cumulative count of bidders (\(N_{applicant} \propto m_{bidder}*{i}\)) and collectors (\(N_{collector} \propto m_{collector}*{i}\)), where i is the art item number, finding that fourscore% of the artists accept \(m_{bidder}>1\). The distribution of \(P(m_{applicant})\) documents the explicit differences betwixt artist groups: for loftier reputation artists the meridian is at \(m_{bidder} \sim two\), while for low and middle reputation artists it peaks at \(m_{applicant} \sim 1\) (Fig. 4G). In other words, loftier reputation artists, attract bidders twice as fast than low and medium reputation artists.

At the same time, 75% of the artists have \(m_{collector}<i\) (Fig. 4H), a slower growth charge per unit indicating that each subsequent sale does not necessarily attract a new collector, bear witness of return purchases by repeat collectors (SI Fig. 13). In dissimilarity with the departure in applicant growth among artist groups, the distribution of collector growth, \(P(m_{collector})\) are indistinguishable for low, heart, and high reputation artists, indicating that new and returning collectors follow a common blueprint. This similarity prompts us to enquire, are at that place differences in investment patterns of collectors based on artist reputation?

Interestingly, we find that level of collector'southward investment across artists is highly uneven (Fig. 4F, I). Nosotros quantify such disparity using the Gini coefficient, that ranges from 0 (consummate equality, when all collectors of an artists have spent the same amount on the artist'southward work) to 1 (extreme inequality, when a single collector buys all of an artist's work). We notice that loftier reputation artists have an average Gini coefficient of 0.53, much higher than the value obtained for medium (0.34) and for low reputation (0.26) artists, indicating that loftier reputation artists derive their earnings primarily from a few collectors who make large and repeat investments, while medium and low reputation artists capture a more than uniform spend from their collector base (Fig. 4I).

Such artist–collector dynamics is well illustrated by the sales of PaulSnijder (\(m_{applicant} = 3.19, m_{collector} = 0.82\)), who has iii (12.five% of all) returning collectors that purchased half-dozen of his artworks (22.ii% of all), spending on them $46,842, representing 61.v% of the artist'south total earnings. The remaining 21 (87.v% of all) collectors account for just 38% of the artist'southward earnings. In general, for the top 180 artists who sold x or more than artworks, the combined 2743 artworks sold by them accept nerveless $5,911,037 from 1264 collectors. However, we find that 414 (32.75%) of these collectors made repeated investment, being responsible for 1893 (69.01% of total) artworks for a total of $4,495,120 (76.04% of earnings). Similarly, 1 of the biggest art collector on the platform, 3FMusic, invested $5,835,379 in 316 art works from 210 artists, focusing much of their portfolio on repeated investment worth $iii,106,445 (53.2%) for 155 (49.05%) artworks from 49 (23%) artists. This indicates that collectors tend to specialize on a small group of preferred artists, spending more than than half of their total budget on them, at the toll of limiting the diverseness of their collection.

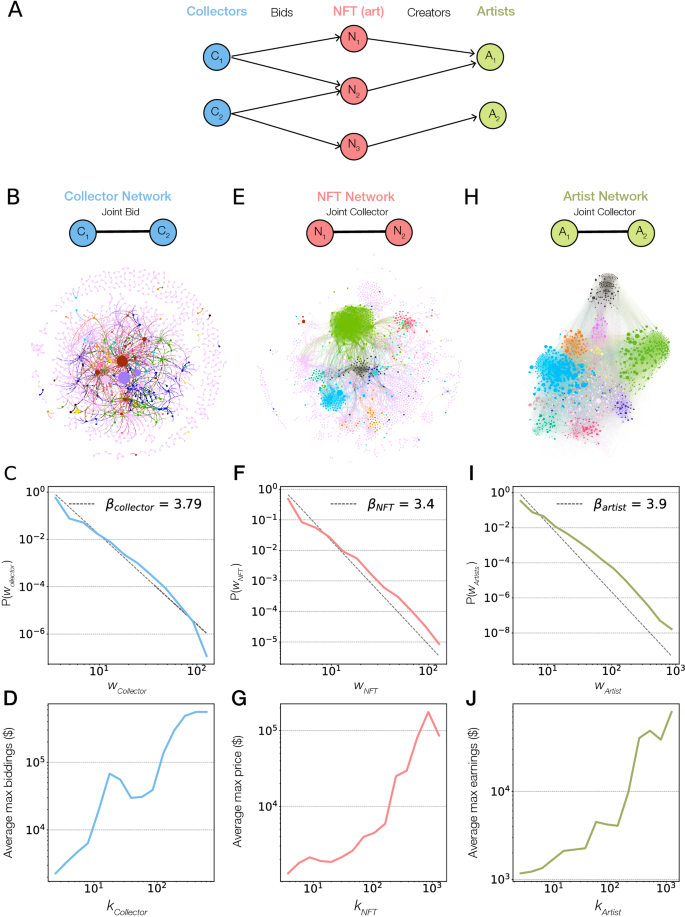

These results highlight that artist–collector ties play a crucial part in the earnings of an artist, suggesting that the success for NFT artists rests on their power to build human relationship with collectors that are willing to repeatedly buy art from them, rather than attracting new collectors. These strong artist–collector bonds are like to the collection patterns observed in the classical art world, where collectors ofttimes focus on a few artists. The evidence of such shut ties between artists, collectors, and artworks prompts united states to systematically map out the co-bidding networks that define success in crypto fine art (Fig. 5A), resulting in iii maps capturing the collector network, the art network, and the creative person network.

Co-bidding networks. (A) Schematic description of diverse co-bidding networks based on NFT transactions extracted from the information, capturing how a collector \(C_1\) bids on an NFT \(N_1\) created by artist \(A_1\). As collectors can bid on multiple artworks, we use these joint bids to reconstruct the collector–collector, NFT–NFT and creative person–artist networks. (B) The collector network has collectors equally nodes and their joint NFT bids as links. The nodes are sized based on maximum investment and the top 10 collectors are highlighted while other collectors are colored in pink. (C) The distribution of edge weights, representing competition, follows a power law disuse \(P(w_{collector}) \propto w_{collector}^{-\beta _{collector}}\) with exponent \(\beta _{collector} = 3.7\), measured using plfit 31. (D) The clan of maximum bidding amount and degree, finding that highly continued collectors make higher bids. (Eastward) The NFT network, where a node is an NFT, connected if the same collector has bid on both the NFTs. The node sizes correspond to the selling cost and the NFTs bid by the peak 10 collectors are highlighted. (F) The distribution of link weights, representing collector similarity, follows a fat tail decay with exponent \(\beta _{NFT} = 3.4\). (G) The association of connectivity and selling toll, finding that central NFTs attract higher prices. (H) The artist network, whose nodes are artists and links correspond to joint collectors. The nodes sizes reflect the total earnings of the artist. Nosotros color the artists based on bids by top 10 collectors while the rest are colored pink, highlighting the stratification of artists among collectors. (I) The distribution of edge weights, representing similar collector interest, follows a fat tail decay with exponent \(\beta _{artist} = 3.9\).

Co-bidding collector network

Collectors are connected to each other if they testify common taste and collector philosophy, revealed by frequent joint bids on the same art. Such bidding wars define a co-behest collector network, whose nodes are collectors and the weighted links between them corresponds to the number of times ii collectors bid on the same artwork (Fig. 5B). The resulting network has 7787 collectors as nodes and 20,417 weighted links with an average degree of v.2. The collectors are fragmented into 2235 components, the largest component accumulating 5223 collectors (67.07%). The number of articulation bids (border weight) determines the competition (or rivalry) between the two collectors. We find that 54.98% of the links between collectors accept weight larger than i, show of repeated common interests. Furthermore, we find that the link weights are well approximated by a heavy tailed distribution, \(P(w_{collector}) \propto w_{collector}^{-\beta _{collector}}\), with exponent \(\beta _{collector} = iii.7\), indicating the presence of remarkably strong links between some collectors, corresponding to over a hundred competing bids (Fig. 5C). We discover the highest rivalry between collectors HypnoPizza and 3FMusic, who have bid against each other on 145 artworks. Finally, we find that having a college degree in the collector network implies higher investment in art (Fig. 5D), indicating that the buying power is full-bodied on the few hubs of the collector network who tend to make considerable investments in cryptoart.

Co-bidding NFT network

The financial success of an NFT is partly determined by its visible features like style, design, content, attracting the interest of collectors with like gustation in art. To uncover potential NFT-NFT connections, we mapped out the co-bidding fine art network, whose nodes are artwork and a weighted link corresponds to the number of shared bidders (Fig. 5E). The resulting network is particularly dense with xv,338 NFTs connected via 547,566 links respective to shared bids. We notice that 82.4% of the NFTs are part of a giant component. The link weights are well approximated by a heavy tailed distribution, \(P(w_{NFT}) \propto w_{NFT}^{-\beta _{NFT}}\), with exponent \(\beta _{NFT} = 3.four\) (Fig. 5F), again show of very strong links between few artworks. Nosotros find once again that the centrality of an NFT in this network, as captured by its degree, is strongly associated with its selling toll (Fig. 5G).

Co-bidding artist network

Ii artists are connected if collectors show simultaneous interest in the work of both artists. Such repeated links may betoken formal, conceptual or stylistic similarities between the ii artist's work. Nosotros therefore reconstructed the co-bidding artist network, whose nodes are artists and the weighted links represent the number of shared collectors (Fig. 5H). The resulting network of 6126 artist ties has an average caste of 91.97. The network has a giant component, consisting of 82.35% of the nodes. The edge weight, capturing the strength of common interest by collectors, follows a fat tailed decay, \(P(w_{artist}) \propto w_{creative person}^{-\beta _{artist}}\), well approximated by a power law with decay exponent \(\beta _{artist} = three.ix\) (Fig. 5I). The artists zawada and PaulSnijder appear to accept the highest weight link between them, having received bids from the same 833 collectors for 36 artworks. We find that the degree of an creative person in the creative person network shows a stiff correlation with the creative person'south earnings: hub artists earn more for their art (Fig. 5J) than the more than peripheral artists.

Summary and discussion

While the traditional art space is at best opaque, as prices and fifty-fifty the act of a sale is often shrouded in secrecy, the transparent nature of cryptoart offers a historical opportunity to quantify and understand the processes that determine success in the art infinite. Taking reward of this open data, here we mapped out the history of a prominent NFT marketplace, the Foundation platform. The data allowed us to explore the auction dynamics, artist–collector ties, and co-bidding networks inside this self-contained crypto fine art ecosystem. We find strong evidence of first movers' advantage, in that innovators and early bulk artists had college earning than the latecomers, and collectors who joined early have also been more engaged, spending more on fine art.

Examining the career of artists, we find that the toll of artworks remains comparable throughout an artist'southward career and its range defines the artist's reputation and popularity. Withal, at that place are significant fluctuations in art prices for the aforementioned creative person, a hit contrast to the patterns seen in the classical fine art world where the price of seasoned artists increases equally they gain visibility, and price drops are avoided by galleries. We classify the reputation of artists into depression, medium, and loftier categories based on the maximum price of the sold artwork, finding that high quality artists repeatedly concenter high prices for their works, prove of persistent market place-driven reputation effects.

But like in the classical fine art space, we observe that artist–collector bonds play an important role. Indeed, collectors tend to develop a unique taste in digital art, prompting them to brand repeated purchases from a small group of artists. Consequently, the earnings of high reputation artists is ensured by multiple, asymmetric investments by a small group of collectors. In contrast, low reputation artists struggle to concenter a sustained collector grouping, leading to low, uniform investments from several collectors. In other words, the careers of successful artists is built past attracting collectors willing to make repeated investment in their fine art, rather than appealing to the larger set of collectors investing in crypto fine art. We show that links between collectors, art, and artists affect the price of fine art, finding that the value of NFTs is driven by strong network effects between artists and collectors.

Our work likewise identified important avenues for hereafter inquiry. For instance, many important quantities, similar the number of on- and off-platform followers, are not encoded in the block concatenation, but are stored on the Foundation platform, hence we are unable to reconstruct their temporal evolution. For example, we practice not know when a collector starts following an creative person. The lack of such temporal data limits our ability to unveil causal furnishings, similar the potential causal impact of rich artist groups on the operation of new artists, or how the number of in-platform followers drives fine art valuation. For such studies to be possible, either the platforms need to supply temporal information for research purposes, or the research community must launch a temporal observatory that monitors all the platform variables in existent time.

Information technology wasn't until a few months agone that the use of NFTs to share, collect, and merchandise art became a mainstream miracle. The coming years, relying on data transparency of the sector, will help explicate the influence of NFTs in shaping culture and art, in the same fashion that concrete art are securely embedded in narrating historical events. As the arrangement establishes itself as a powerful medium of artistic expression, teasing out the networks that drive art prices and artist success will be of the utmost importance.

In many ways, this and other similar works10,12,13,21 are only the beginning of a larger inquiry program needed to explain the multi-faceted impact of NFTs on fine art and society. Many pertinent questions remain to be addressed, like the difference between unmarried versus multiple editions of the same artwork, the role of generative art, and most importantly, how NFT artists build a customs of collectors, and how do these community effects shape the careers of an artist. The underlying reproducible patterns identified here, pertaining to artists, collectors, and bidding patterns, demonstrate how data and network science tools tin help unveil the processes governing the emergence of the NFT ecosystem.

References

-

Velthuis, O. An interpretive approach to meanings of prices. Rev. Aust. Econ. 17, 371–386 (2004).

-

Taylor, J. Visual Arts Direction (Routledge, 2017).

-

Bourdieu, P. The Field of Cultural Production: Essays on Fine art and Literature (Columbia University Press, 1993).

-

Harris, J. Gatekeepers, poachers and pests in the globalized gimmicky art world organization. Third Text 27, 536–548 (2013).

-

Ginsburgh, Five. A. & Van Ours, J. C. Good opinion and compensation: Evidence from a musical competition. American Economical Review 93, 289–296 (2003).

-

Robertson, I. The international art market. Underst. Int. Art Marking. Manag. 66, 13–36 (2005).

-

Wang, D. & Barabási, A.-L. The Scientific discipline of Science (Cambridge University Press, 2021).

-

Fortunato, South. et al. Scientific discipline of science. Science 359, 66 (2018).

-

Fraiberger, S. P., Sinatra, R., Resch, Thousand., Riedl, C. & Barabási, A.-50. Quantifying reputation and success in art. Science 362, 825–829 (2018).

-

Taylor, J. & Sloane, K. Art markets without fine art, art without objects. Garage J. Stud. Fine art Museums Cult. 02, 152–175 (2021).

-

Chen, Due west., Xu, Z., Shi, S., Zhao, Y. & Zhao, J. A survey of blockchain applications in different domains. In Proceedings of the 2018 International Conference on Blockchain Technology and Awarding 17–21 (2018).

-

Dowling, M. Is non-fungible token pricing driven by cryptocurrencies?. Finance Res. Lett. 66, 102097 (2021).

-

Wang, F.-Y., Qin, R., Yuan, Y. & Hu, B. Nonfungible tokens: Constructing value systems in parallel societies. IEEE Trans. Comput. Soc. Syst. 8, 1062–1067 (2021).

-

Franceschet, M. et al. Crypto art: A decentralized view. Leonardo 66, one–8 (2020).

-

Franceschet, M. & Braidotti, C. Enhancing art with information: The case of blockchain art (2021).

-

Bamakan, S. Grand. H., Nezhadsistani, N., Bodaghi, O. & Qu, Q. A Decentralized Framework for Patents and Intellectual Property as nft in Blockchain Networks (2021).

-

Howcroft, Due east. NFT sales volume surges to 2.5 bln in 2021 first one-half. Reuters six, 66 (2021).

-

Ante, L. Not-fungible token (nft) markets on the ethereum blockchain: Temporal development, cointegration and interrelations. Available at SSRN 3904683 (2021).

-

Barabasi, A.-L. The fine art market ofttimes works in undercover. here's a wait within. New York Times (2021).

-

Franceschet, K. Fine art for space. J. Comput. Cult. Herit. thirteen, 1–9 (2020).

-

Nadini, G. et al. Mapping the NFT Revolution: Market Trends, Trade Networks and Visual Features (2021).

-

Mitali, B. & Ingram, P. 50. Fame as an illusion of creativity: Bear witness from the pioneers of abstract fine art. HEC Paris Research Newspaper No. SPE-2018-1305, Columbia Business School Research Newspaper (2018).

-

Campos, Northward. F. & Barbosa, R. Fifty. Paintings and numbers: An econometric investigation of sales rates, prices, and returns in latin American art auctions. Oxf. Econ. Pap. 61, 28–51 (2009).

-

Marinelli, North. & Palomba, G. A model for pricing Italian contemporary art paintings at sale. Q. Rev. Econ. Finance 51, 212–224 (2011).

-

Christie's. Beeple everydays: The offset 5000 days (2021).

-

Rogers, E. Thousand. Diffusion of innovations (Simon and Schuster, 2010).

-

Lengyel, B., Bokányi, E., Di Clemente, R., Kertész, J. & González, M. C. The office of geography in the complex diffusion of innovations. Sci. Rep. 10, ane–11 (2020).

-

Merton, R. K. The Matthew event in scientific discipline: The reward and communication systems of science are considered. Scientific discipline 159, 56–63 (1968).

-

Barabási, A. .-50. & Albert, R. Emergence of scaling in random networks. Science 286, 509–512 (1999).

-

Sinatra, R., Wang, D., Deville, P., Song, C. & Barabási, A.-L. Quantifying the evolution of individual scientific touch on. Science 354, 66 (2016).

-

Clauset, A., Shalizi, C. R. & Newman, 1000. Due east. Power-law distributions in empirical information. SIAM Rev. 51, 661–703 (2009).

Acknowledgements

We thank Foundation (foundation.app) for making the data accessible for inquiry purposes. We likewise thank Luca Maria Aiello of University of Copenhagen for useful insights on data drove and Alice Grishchenko for help in designing the figures.

Author information

Affiliations

Contributions

All authors conceived and designed the experiments. Grand.V. conducted the data collection, analysis, and created the visualizations. M.V. and A.-L.B. wrote the manuscript. All authors reviewed the manuscript and offered comments.

Corresponding writer

Ethics declarations

Competing interests

A.-50.B. is the founder of Scipher Medicine and Foodome, companies that explore the utilise of network-based tools in health. A.-L.B and MJ are founders of Datapolis, that focuses on urban data. KV declares no competing involvement.

Boosted data

Publisher's notation

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary Information

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution iv.0 International License, which permits employ, sharing, adaptation, distribution and reproduction in any medium or format, every bit long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third political party fabric in this commodity are included in the article'southward Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended utilize is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a re-create of this licence, visit http://creativecommons.org/licenses/past/4.0/.

Reprints and Permissions

About this commodity

Cite this article

Vasan, K., Janosov, M. & Barabási, AL. Quantifying NFT-driven networks in crypto art. Sci Rep 12, 2769 (2022). https://doi.org/10.1038/s41598-022-05146-6

-

Received:

-

Accepted:

-

Published:

-

DOI : https://doi.org/10.1038/s41598-022-05146-six

Comments

By submitting a comment you agree to abide past our Terms and Community Guidelines. If you find something abusive or that does not comply with our terms or guidelines delight flag it as inappropriate.

Source: https://www.nature.com/articles/s41598-022-05146-6

0 Response to "Sell to Art Gallery Vs Sell to Collector Sim 4"

Postar um comentário